Kerala government has launched CM Helping Hand Loan Scheme (CMHLS) for Kudumbashree women. In this Sahayahastham (helping hands) scheme, govt. will provide interest free loans to women neighbourhood groups whose livelihood have been affected by Covid-19 pandemic. This Kudumbashree Sahayahastham (CMHLS) scheme would benefit 35 lakh women in the state with an outlay of Rs. 2,000-crore. All the beneficiaries within neighbourhood group can get a maximum amount of Rs. 20,000 as loan.

The repayment time of interest free loans under CM Helping Hand Loan Scheme (Sahayahastham) is 36 months (3 years). Moreover, the repayment includes six months moratorium. This CMHLS interest free loan scheme for Kudumbashree women is part of the Rs. 20,000 crore economic package announced by the Chief Minister in the wake of pandemic in March 2020.

The state minister A C Moideen launched the scheme by distributing loans to 2 neighbourhood groups in Thiruvananthapuram Corporation on 22 April 2020. The scheme will be implemented on the lines of “Resurgent Kerala” loan scheme introduced after the floods.

Kudumbashree CM Helping Hand Loan Scheme (Sahayahastham)

Kudumbashree is currently in the process of implementing Chief Minister’s Sahayahastham interest free loan scheme declared by the Government of Kerala. In this CM’s Helping Hand Loan Scheme (CMHLS), Kudumbashree NHGs will be given interest free loans as indicated in the guidelines. Kudumbashree received the Government order regarding the same on 5 April 2020 and a detailed guideline by the Executive Director has been prepared. The loan applications are going to be submitted to the banks.

| Proposal given to government | Click here |

| Government Order | Click here |

| SLBC Minutes | Click here |

| Circular from the Registrar of Co-operative Departments | Click here |

| Circular from the Executive Director, Kudumbashree | Click here |

| Letter given to the DMCs | Click here |

| Official Page | http://www.kudumbashree.org/pages/825 |

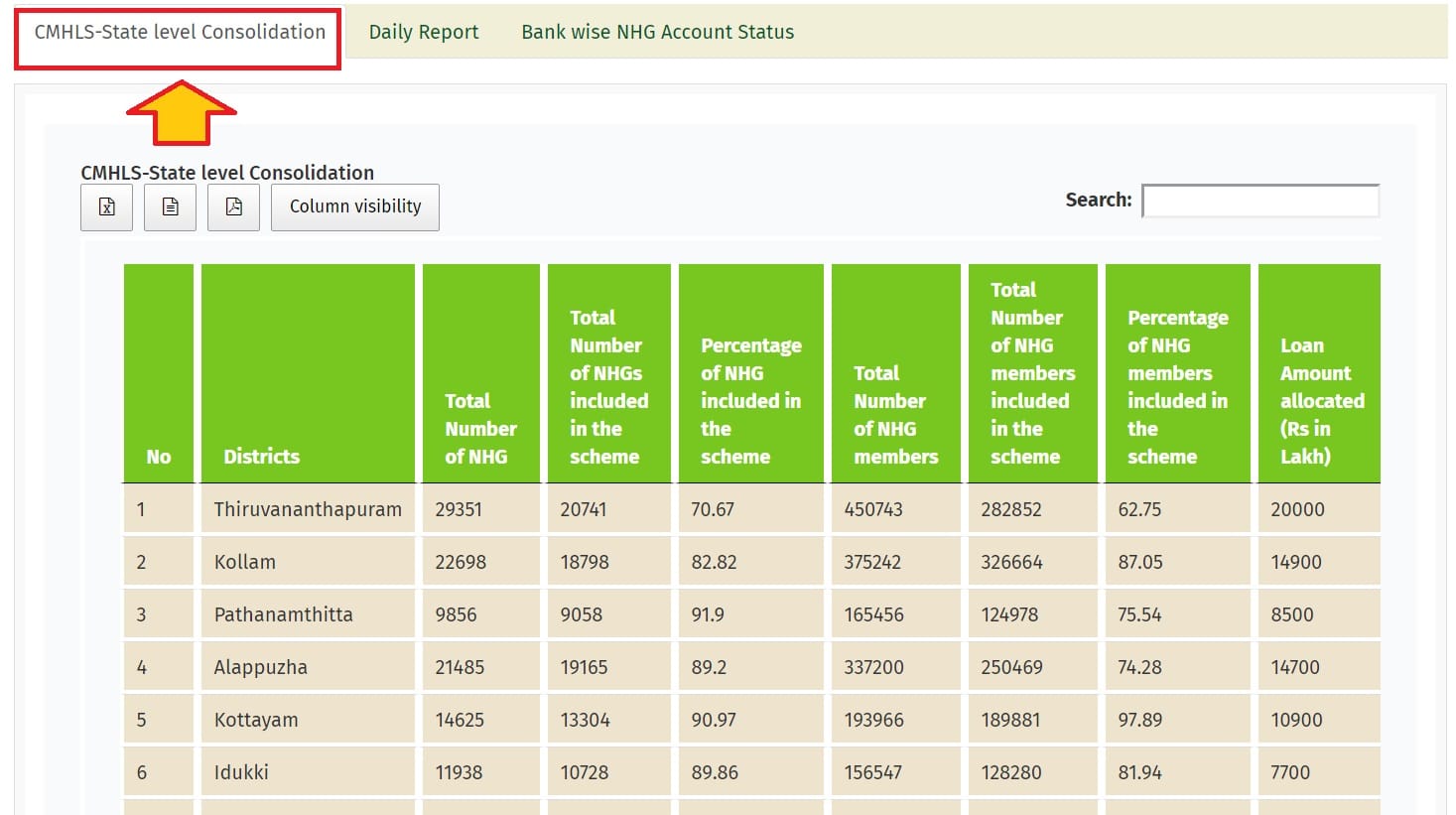

Kudumbashree CMHLS State Level Consolidation Report

People can now check the Kudumbashree CMHLS State Level Consolidation report at the official website’s homepage. Here applicants can click at the “CMHLS-State Level Consolidation” link as shown below:-

CM Helping Hand Loan Scheme CMHLS Sate Level Consolidation

This CMHLS state level consolidation report comprises of district name, total number of NHG / NHG members, total NHGs / NHG members included in the scheme, percentage of NHG / NHG members included in the scheme and loan amount.

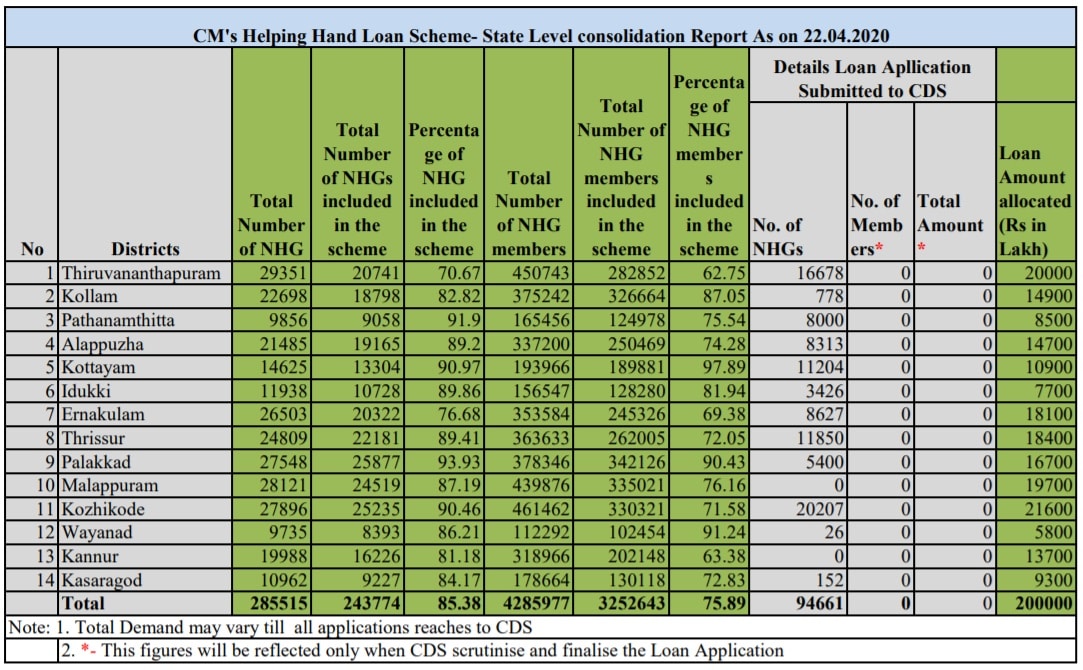

Kerala Sahayahastham Interest Free Loan Scheme Daily Report

All the applicants can even check the Kerala Sahayahastham Interest Free Loan Scheme Daily Report by visiting the official page and clicking the link “Daily Report“. Then in the new window, click at the “Download” option to check daily reports:-

Kudumbashree Sahayahastham Loan Scheme Daily Report

Daily report is updated on a daily basis and the process to check daily report remains the same. Here we have shown you the daily report of CMHLS scheme as on 22 April 2020. For further dates, you can check the reports on the daily basis by clicking at the Daily reports link.

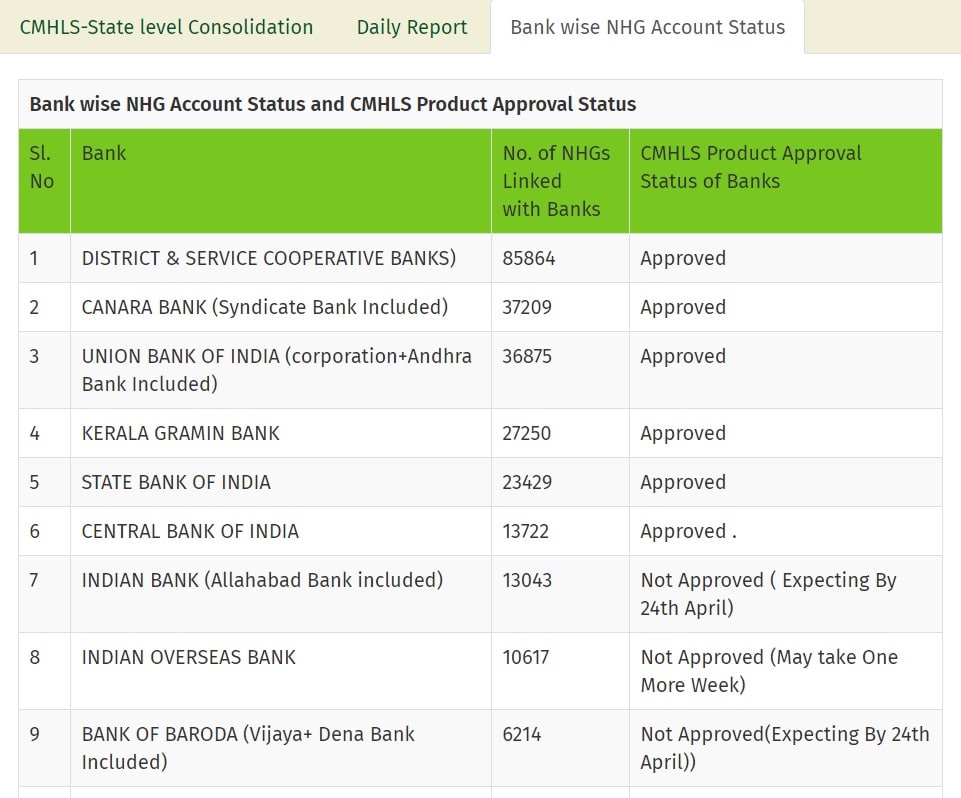

Kudumbashree Interest Free Loans NHG Account Status (Bank-Wise)

Just like in the earlier section you have clicked ‘CMHLS State level consolidation’ link, now click the “Bank Wise NHG Account Status” link. This will open the Kerala Kudumbashree interest free loans NHG account status (bank wise) as shown below:-

Kerala Kudumbashree Interest Free Loans NHG Account Status Bank Wise

This list comprises of the name of the bank, number of NHGs linked with the bank and CMHLS Product Approval Status of Banks. All the eligible beneficiaries will get minimum amount of Rs. 5,000 directly into their bank accounts. The banks charge 9% interest on the loan and the government will cover the interest as subsidies through beneficiaries. The decision was taken at a meeting with the Kudumbashree Mission, Cooperative department and state-level banker’s committee.